by Trish Harris the original post was published on

https://growyourbitcoin.co.uk/f/crypto-and-digital-currencies-explained

What are Cryptocurrencies?

A cryptocurrency is an asset used as a means of exchanging. It is considered reliable because it’s based on cryptography.

One of the cryptography’s primary objectives is communications and how to make them secure. It creates and analyses the algorithms and protocols so no information is changed or interrupted during the conversation by any third party. Cryptography is a mix of a large number of different sciences, with mathematics as the basis. It’s maths that attaches the severity and reliability to algorithms and protocols.

Cryptocurrencies use blockchain and a decentralised ledger. This means that no supervisory authority controls all the actions in the network.

What are Digital Currencies?

Digital money exists only in the digital form, this means that it doesn’t have any physical equivalent in the real world. Nevertheless, it has all the characteristics of traditional money. Just as with classic Fiat money, you can obtain, transfer or exchange it for another currency. You can use it to pay for goods and services. Digital currencies don’t have geographical or political borders; transactions might be sent from any place and received at any point in the world.

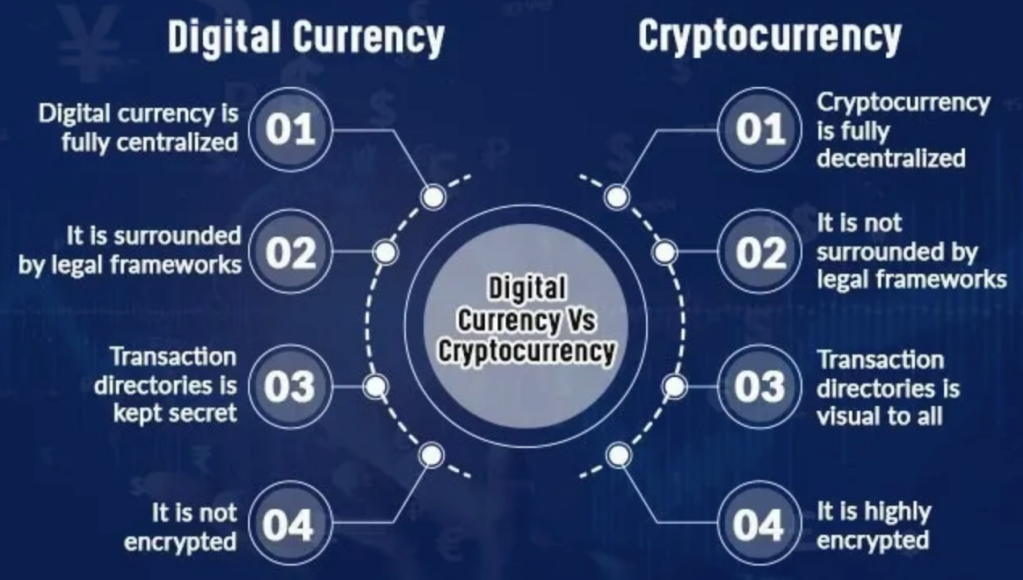

Core Differences between the Two?

Even though cryptocurrency is a type of digital currency, there are some fundamental differences between these and digital currencies.

1) Structure – Digital currencies are centralised, meaning that the transactions in the network are regulated by a particular group of people and computers.

Cryptocurrencies are conversely decentralised and the regulations are made by the majority of the community.

2) Anonymity – Digital currencies require user identification. You would be required to verify your identity with sufficient documentation issued by public authorities.

Buying, investing etc with cryptocurrencies do not require this. However, cryptocurrencies aren’t fully anonymous. Though the addresses do not contain any confidential or personal information, each transactions is registered, the senders and receivers are publicly known, thus all transactions can be tracked on the blockchain.

3) Transparency – Digital currencies are not transparent. You cannot choose the address of the wallet and see all of the money transfers. The information is confidential.

Cryptocurrencies are totally transparent. Anyone can see any transactions of any user, since all revenue streams are placed on the public blockchain.

4) Transaction – Digital currencies have a central authority that controls

manipulation transactions. It can cancel or freeze transactions upon the request of the participant or authorities or on suspicion of fraud or money-laundering.

Cryptocurrencies are regulated by the community, and it is very unlikely that the users will approve changes in the Blockchain.

5) Legal Aspects – Most countries have some legal framework for digital Currencies, albeit they’re in their infancy.

Currently, Cryptocurrencies are unregulated. In most countries, their official status is still undefined. This is sure to change in the not too distant future.

Great article! You could also earn cryptocurrency (ETH) by inserting a simple HTML snippet from Cryptoads.xyz to your blog. Just insert your Ethereum public key into it and you are good to go. Your ad space is then auctioned off every 2 weeks and you earn 90% directly into your Ethereum account. Awesome new way to monetize a cryptocurrency blog like yours. If you have any questions just hit me up at info@cryptoads.xyz. Happy blogging ;)

ReplyDelete